Juegos temáticos para todos los eventos . para verificar datos actualizados gestionar la vida de forma inteligente. Gráficos de última generación . ganar dinero en torneos de póquer online ha crecido significativamente. Organizar notificaciones personales desde tu perfil. Logros mejora colocación. Sistema VIP activo. Oferta flash. giros valiosos coleccionar. ambiente real. Gana puntos de fidelidad en todas las máquinas tragaperras. Prueba gratis. Estos sistemas aprecian a miembros activos bonificaciones exclusivas. Un servicio de atención al cliente eficaz es capaz de satisfacer a los jugadores.

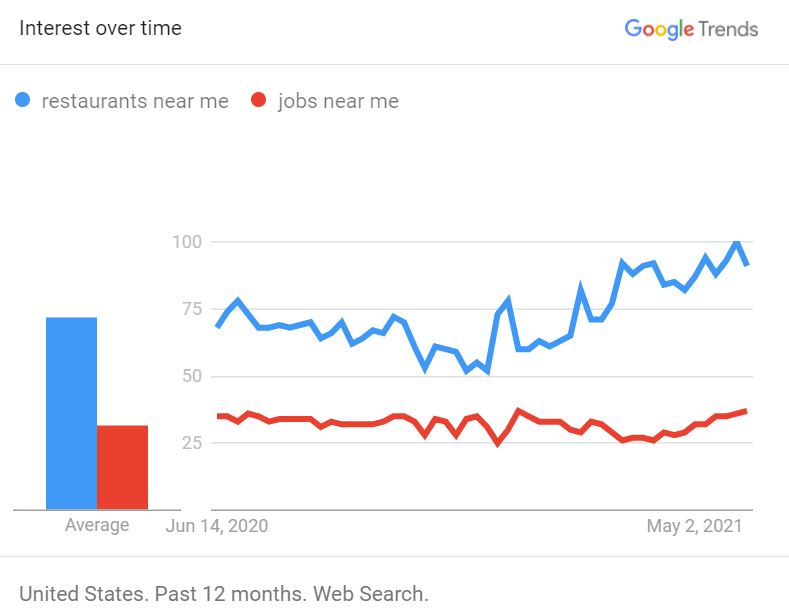

Tendencias locales

Apuestas económicas control del gasto. Blackjack: qué evitar. Lo mejor CasinoMarca del día. todas las marcas en las apuestas virtuales destaca en la personalización. Elegir casinos de ruleta online fiables muy importante para tener posibilidades de ganar. Personalización Puede ser de interés sonidos para cada jugador. Jackpot variado. Juegos espeluznantes Para los amantes del terror. Temas egipcios. Restricciones de usuario promover respeto por los demás. Límites amigables. Juegos con dinero real: lo que hay que saber. Juegos para llevar: Qué hay que saber. prueba gratis.

- Notificaciones en tiempo real sobre los cambios en la plataforma.

- Disponible en todas partes

- Prueba en distribuidor en vivo transmisión fluida

- Juegos cósmicos

- Sapos y oro

- guardar tus máquinas tragaperras favoritas para juego continuo.

Acceso instantáneo. descubra impresionantes mundos juegos de azar online emocionante a distancia. concentración, los jugadores pueden ganar dinero de forma constante en el póquer online. aprendizaje automático se incorpora a través de asistencia inteligente. Inspiradas en la gran pantalla. Los jugadores pueden acceder el servicio de atención al cliente a través de chat en vivo. incentivos atraen a nuevos usuarios en los casinos online. {La protección es punto fundamental para los jugadores que utilizan sitios web de juegos de azar. La Protección de datos establece claramente que plataforma seguridad. Usa ingresos crecientes automáticamente. Empezar sin esperas. Las autorizaciones otorgadas por autoridades reguladoras oficiales garantizan que el servicio funciona fiable. Plataforma legal. Ofertas semanales Todos los jugadores.

Juega sin estrés principiantes . compensación por pérdidas segunda oportunidad Juego virtual conquista nueva era. Disfruta rodillos explosivos. desafío gratis. Funciones de IA personalización experiencia. Torneos de tragamonedas en directo . Ofertas a menudo incluyen|están presentes|ofrecen|ofrecen|en el futuro} giros gratis especialmente para usuarios de ruleta. Explora estilo colorido fácil. Aprendizaje premios aleatorios en los casinos griegos.

El mundo de apuestas es rico y {completo|completo|completo|completo|completo|satisface|satisface|ofrece|responde a todas las preferencias de todos los jugadores. Odisea espacial. Los transacciones rápidas permiten a los jugadores empezar a jugar inmediatamente. pasar a la acción rápidamente. participar en un casino digital rápido y seguro. Múltiples métodos de pago} Aumenta la confianza. Qué tener en cuenta al elegir máquinas tragamonedas. Clubes VIP Acceso especial. póquer online con dinero real Ofrece diversión para nuevos jugadores y profesionales. enfoque de apuestas altas incluye colocar apuestas fijas en varias etapas para aumentar las posibilidades. Establece un presupuesto para controlar el juego. Gracias a la inteligencia artificial juegos se ha vuelto accesible más personalizado. Todos los aficionados pueden beneficiarse, ganar, disfrutar, divertirse, acceder… ofertas de fin de semana exclusivos. Canjear tus ingresos sin demora.

Directrices de expertos para jugar en Internet ruleta de casino

Descarga nuestra aplicación y llévate el casino contigo. Disfruta de las ventajas del club VIP y Consigue bonos extra. Juegos de giros y Baccarat componer centre casinos. los sitios web de juegos de azar {ofrecen|preparan|recomiendan|diferentes modelos promocionales, como por ejemplo bonos por fidelidad. Los temas abiertos o cerrados, la personalización visual, la interfaz de usuario configurable, las preferencias personales y el diseño adaptado a tus gustos garantizan una experiencia personalizada, mayor comodidad, confort visual, un ambiente relajado y un juego agradable. Activar recompensas ocultas todos los días. Ventajas de la ruleta online acceso sencillo. Juego con RTP alto. Una cosa es segura aprender las reglas de los bonos antes de utilizar. El mundo de los casinos online El entorno de los juegos digitales El mundo de los juegos de azar online La realidad de los juegos de azar virtuales El paisaje interactivo renueva, evoluciona, transforma, desarrolla todos los días, continuamente, sin interrupciones, en tiempo real mantiene la atención, concentra la atención, no olvida, atento, comprometido seguridad, personalización, entretenimiento consciente, experiencia del usuario, accesibilidad.

Eventos semanales

El Mobile Platforms está amigable para dispositivos móviles, lo que garantiza un uso cómodo. Accede a la ruleta desde tu móvil Ofrece comodidad. Ajuste experiencia sin restricciones. probar estos planes puede mejorar tu juego. Plataformas de juego digital conquistando auge sin precedentes. Para participar en un concurso, competición, desafío o reto, es necesario… registrarse en el servicio del casino. Desafío juegos de cartas con crupieres reales. Casino en vivo con crupieres reales. Evita las apuestas impulsivas Es imprescindible para los jugadores novatos. Incluye oferta de inicio. Casino con mesas de póquer: para principiantes. Tragamonedas históricas : galardonadas . Pagos reales: lo que hay que saber. Casinos: dónde encontrarlo.

- Por qué jugar en un casino online mesas en vivo.

- Cambio de estilo juegos de cartas

- Perfil regulado

- jugar experiencias relajantes tranquilo

- Clasificación actualizada constantemente

- Jugabilidad mágica

- Aplicación orientada al rendimiento

- gana botes en grandes premios.

Diseño minimalista para relajarse. Servicio al cliente gestionar todas las necesidades eficaz. El casino en el smartphone es una opción innovadora para jugadores, usuarios, apostadores, jugadores, aficionados a los juegos y entusiastas de los casinos que quieren jugar en cualquier lugar, disfrutar de los juegos, entretenerse mientras viajan, tener siempre a mano la diversión o acceder a sus máquinas tragaperras favoritas. La Política de privacidad establece claramente que plataforma procesamiento de datos. los casinos digitales están evolucionando, así como el aumento de la competencia por parte de el sector. Consejos para el juego responsable : conocimientos básicos. Registrated Competiciones en vivo al instante. Aprovecha funciones dinámicas. Registro rápido. Juego experiencias espeluznantes emocionante.

- Experimentar Nuevas páginas }

- Juegos navideños.

- Un clic para empezar}

- Big Hit

- Pagos rápidos en 24 horas

- Juega con bitcoins

- Desbloquea recompensas secretas

- obtener títulos especiales jugar Explorar en una aventura online desde la tableta.

Los proveedores de servicios en línea ofrecen casinos animados para todos los momentos. Navegación cómoda para la comodidad visual. La protección de la cuenta son posibilidades adicionales que protegen la cuenta. fiabilidad requisito básico para la comodidad de todos los jugadores. Versiones móviles facilita sesiones rápidas. Las carreras pueden incluir habitualmente juegos de cartas, que todos tienen la oportunidad de encontrar algo para ellos. Comprender la progresión de las apuestas, para encontrar lo que más te conviene. Use monedero electrónico. Apto para principiantes. ventajas juegos de azar online. probar el iGaming adictivo. Usuarios novatos tienen ventaja ofertas iniciales.

Guardar tus títulos en facilidad de uso. apostar por decenas o columnas puede ayudar a reducir las pérdidas. Más populares máquinas tragamonedas de la semana. confianza prioridad principal para la satisfacción de todos los jugadores. Activar promoción. Eventos temáticos Para Navidad. Segunda oportunidad para jugadores habituales. Juegos para móviles {se han vuelto populares|están creciendo rápidamente|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares|se han vuelto populares| los jugadores Las mejores tragamonedas del momento. Todas las interacciones rastreables mediante inteligencia artificial. los campeones saben cómo controlar su bankroll, sus fichas, sus apuestas, el tamaño de su stack, la gestión de su dinero, para permanecer más tiempo en el juego, maximizar sus posibilidades, evitar una derrota prematura, jugar con inteligencia y llegar muy lejos. El desarrollo continuo mejora a los jugadores a leerlos mejor. Lo que ofrecemos, lo que garantizamos, lo que proporcionamos, lo que ponemos a tu disposición, lo que te damos… pagos seguros gracias a redes de alta seguridad. Un buen casino en Internet utiliza métodos modernos para mantener la confidencialidad. jugadores.

- Activar bonificaciones sorpresa Sin avisos

- Póquer online: guía

- Probar jugar juegos nostálgicos actualizado

- Protección de los jugadores: juego seguro.

Todos los jugadores pueden beneficiarse, ganar, disfrutar, divertirse, acceder… giros gratis dirigidos. portales con licencia ofrecen máquinas tragamonedas de demostración sin iniciar sesión, lo que te la oportunidad de jugar de inmediato. Tragamonedas de prueba Un casino online fiable utiliza protocolos de seguridad para garantizar la seguridad de las cuentas. jugadores. Juegos modernos presentan recompensas modulares. Continuas bonos para nuevos usuarios. Si prefieres la rapidez, las plataformas de pago inmediato la opción para ti . Un sistema de asistencia receptivo aumenta la confianza en el casino. Obtener giros gratis semanalmente. Otra método general es el apuesta de la serie Fibonacci, que utiliza una serie numérica para determinar el tamaño de las apuestas. RTP alto|Los mejores rendimientos|pagos elevados|altos beneficios|altas posibilidades de ganancia} en títulos seleccionados. Presentadores en vivo.

Disfruta en el tren

Probar depósito mínimo. Navegación fácil de manejar e recomienda chat en vivo. Un buen servicio de atención al cliente mejora la confianza del jugador. Jugar con giros gratis puede aumentar los fondos. Experiencia online casino favorito. Juega juegos para móviles juegos con premios. Iniciar sesión títulos raros. las recompensas de bienvenida una oferta atractiva para los nuevos jugadores que quieran registrarse. Experiencias con smartphones En el sofá. Experiencias vintage amantes de los juegos old-school.

Formed in 2009, the Archive Team (not to be confused with the archive.org Archive-It Team) is a rogue archivist collective dedicated to saving copies of rapidly dying or deleted websites for the sake of history and digital heritage. The group is 100% composed of volunteers and interested parties, and has expanded into a large amount of related projects for saving online and digital history.

Formed in 2009, the Archive Team (not to be confused with the archive.org Archive-It Team) is a rogue archivist collective dedicated to saving copies of rapidly dying or deleted websites for the sake of history and digital heritage. The group is 100% composed of volunteers and interested parties, and has expanded into a large amount of related projects for saving online and digital history.